Index funds, also known as exchange traded funds (ETFs), are funds that seek to track a given benchmark index.

ETFs may be benchmarked to fixed income or equity indices, although to use an index, one must comply with the criteria established in CVM Instruction 359 and subsequent amendments.

They are constituted as open-ended and with an unlimited duration, so shares in them can be created and redeemed at any time. ETF shares are also traded on the secondary market, on stock exchange or over-the-counter markets.

ETFs invest in portfolios of financial assets aimed at reflecting the variations and profitability of its underlying index. They shall invest at least 95% of their portfolio in assets that are part of their benchmark index and/or "long" (bought) positions in future contracts that reflect the index's performance.

CAIXA ETF IBOVESPA (XBOV11) seeks to reflect the IBOVESPA, the leading equity index on the Brazilian market.

The above comparative chart was produced mainly considering the similarities and differences between stock-class investment funds constituted as open-ended, governed by CVM Instruction 555.

The following are some advantages of investing in an ETF. (Please bear in mind that investment should always suit the investor's risk profile and investment time horizon, that past profitability does not provide any guarantee as to future profitability, and that the investor should carefully read a fund's bylaws before investing in it.)

- Low cost – When compared with traditional equity funds, ETFs tend to have a lower administration fee. This fee is debited in proportion to the investment period: investors will only be charged for the days they hold the shares in their portfolio, as in the case of traditional equity funds.

- Diversification – Through just one operation, an ETF investor acquires a basket of stocks and obtains the advantages of lower fluctuation in investment value that diversification normally provides. After all, not all stocks rise and fall in value simultaneously and at the same speed.

- Flexibility – It is possible to gradually buy or sell an ETF share at any time, as if it were a stock. In many traditional equity funds, there are requirements for minimum investment sums and the times and windows for entering and exiting the investment are more restricted. Note that sums are credited and debited to/from shareholders' accounts three days after the respective operation ("D+3"), as with normal equity market operations.

- Practicality – ETFs enable investors to track alterations in an index's composition or proportions without having to buy or sell stocks.

- Transparency – It is possible to know the ETF's composition at any time. Many equity funds publish information about their portfolio only once a month.

- Accessible – It is possible to start investing even with a small amount of money.

How to invest

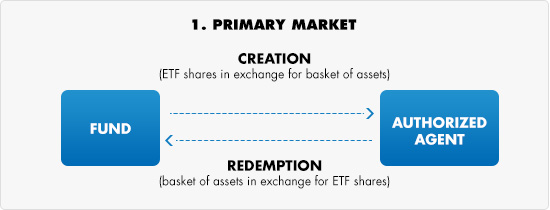

Investors have two options for buying an ETF share: through the primary or secondary market. See the simplified flowchart below, which illustrates purchase and sale operations for XBOV11 shares on the primary and secondary markets:

Primary Market

To invest via the primary market, shareholders need to contact one of the

authorized agents, to request creation of shares in the ETF through the delivery of the assets that comprise a creation basket. They also need to go through an agent to redeem their shares, whereby they receive the assets that comprise a redemption basket.

Minimum batch for XBOV11 transactions via the primary market: 50,000 (fifty thousand) shares.

Secondary Market

Another way of accessing ETFs is to buy shares on the secondary market. The process is similar to that for buying a stock – you just need to have an account with any securities broker. Individual CAIXA bank account holders can simply buy and sell ETFs using CAIXA's home broker.

Standard lot for investment via the secondary market: 10 (ten) shares.

Investors can create shares on the primary market and sell them on the secondary market, or purchase them on the secondary market and redeem them on the primary market, in accordance with the minimum batches for transactions on these markets.

For example, an investor create a minimum batch (50,000 shares) on the primary market and sell 10,000 shares on the secondary market, or make a series of purchases on the secondary market and, upon reaching one minimum lot (50,000 shares) or multiples thereof, redeem the shares on the primary market.

Strategies permitted by legislation and how the funds offered on the site relate to them

Current legislation prohibits the leveraged, inverse and synthetic index funds. Leveraged funds can have the goal of reflecting multiples of the performance of an index, while inverse funds seek to achieve the opposite performance of an index, and synthetic funds use derivatives to reproduce an index's returns.

Thus, legislation only permits passive management strategies, i.e. those aiming to reflect the performance of a benchmark index by investing in assets in order to "replicate" the composition of an index portfolio and thereby keep the fund's performance close to its variation.

XBOV11 seeks to reflect the performance of the IBOVESPA index.

Regulation of index funds

CVM Instruction 359 of January 22, 2002

These instructions govern the creation, administration and operation of index funds with shares traded on a stock exchange or over-the-counter market.To see the complete instruction,

click here.

Income Tax Regulations – RIR/99

These regulate the taxation, inspection, collection and administration of the Tax on Income and Earnings of Any Nature.To see the complete regulations,

click here.

How index funds achieve their goal

Considering that index funds in Brazil only seek to reflect the performance of their benchmark (underlying) index, this goal may be pursued in the following ways: through full replication of the theoretical portfolio of the benchmark index; by taking long positions through futures contracts traded on the commodities and futures exchange that are linked to the index; by using a combination of both of these strategies; or through portfolio management optimization techniques that use selective sampling based on correlation studies to permit the replacement of relatively illiquid components.

XBOV11 tracks the profitability of the IBOVESPA index using full replication of the composition of the index portfolio, and its objective is to invest in financial assets and securities that comprise the index in any proportion, in line with diversification limits and the portfolio's composition, as set forth in the bylaws.

How an investor can follow up market value of share and portfolio of ETF

Investors can follow up the market value of share and portfolio of XBOV11 through the following sources:

-

The fund's exclusive websiteIn the case of XBOV11, the fund's website can be accessed directly at

http://www.caixa.gov.br/etf.In the Reports tab, you can find key information about the fund, such as its portfolio, monthly profitability and daily performance.

-

CVMThe Brazilian Securities Commission (CVM) website shows daily changes in fund share prices. Go to

http://www.cvm.gov.br/, select Investment Funds in the Quick Access menu and do a search for the fund using its official registered name or CNPJ number and select the Daily Data item. For CAIXA's ETF, type "CAIXA ETF IBOVESPA FUNDO DE ÍNDICE" or "14.120.533/0001-11."

-

BMF&BOVESPAAs with the prices of stocks traded on the stock exchange, BMF&BOVESPA also provides the up-to-date prices of ETFs. Go to

http://www.bmfbovespa.com.br/, select Funds/ETFs on the Markets tab, and then select the ETF – Index Funds menu.